Retail banking, also known as consumer banking, offers financial services to the general public. Typical services offered by retail banks include checking and savings accounts, personal loans, credit card access, and mortgage loans.

This guide covers definitions of retail banking and customer segmentation and a discussion exploring common types of retail banking customer segmentation, how data analytics are used in customer segmentation and the benefits of segmentation.

What Does Customer Segmentation Look Like in Retail Banking?

Retail banking services are commonly provided by financial institutions at physical locations, or branches, where customers can manage their money and speak in-person with a banking agent regarding other financial services or products offered.

Most services can be provided at ATMs or through mobile banking platforms, which in recent years have gained substantial traction. Since these institutions have a broad customer base, banks often group their customers into categories based on similar traits, a process known as customer segmentation.

Customers that make up a retail bank’s user base can vary widely by numerous factors including age, gender, income, lifestyle, etc. Banks can segment their customers into lists dividing their consumers into groups based on certain key characteristics and take actions that better align with each segment.

Obtaining and acting on customer data through the lens of segmentation can have a massive impact on marketing and sales, retention efforts, customer service, and more.

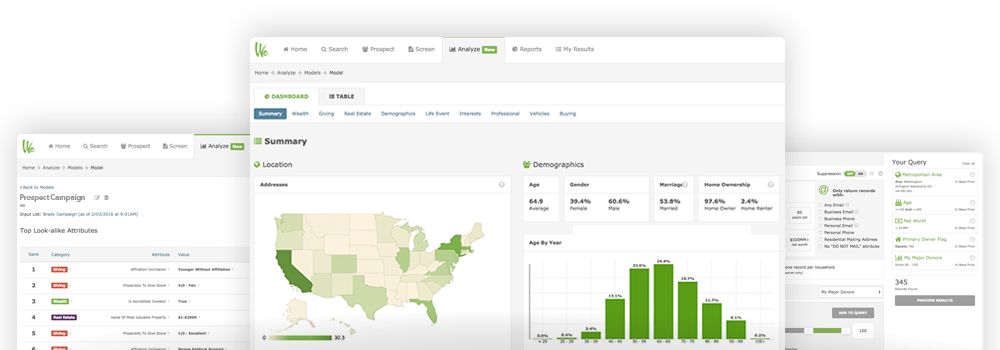

Carefully analyzing such a high volume of customer data can be daunting. By using tools and software like WealthEngine’s Analyze feature, retail banks can easily capture data such as spending habits, frequency, and capacity, and then use this information to identify the most appropriate time to make a loan offer. In turn, this targeted action improves the likelihood of retail banks earning increased revenue through customer loans.

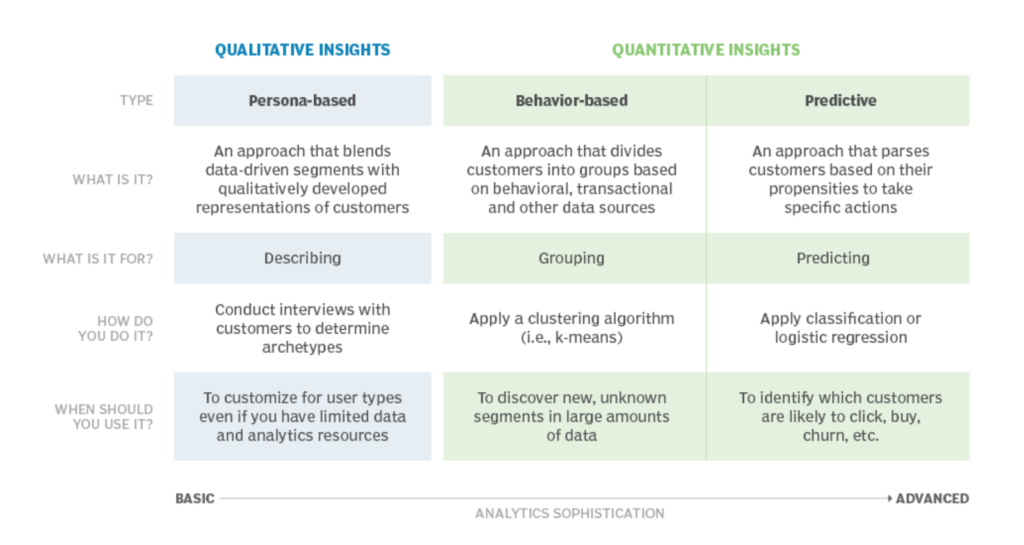

A bank’s customer segmentation approach can vary widely and must be based upon the organization’s business model and priorities. Segments can be quantitative, such as by age and gender, or they can be qualitative, such as separation by values and interests.

Maximum value is obtained when banks merge both types of data to better understand the wants and needs of their customer segments, allowing them to offer the right product or service at the right time.

Common Types of Retail Banking Customer Segmentation

There are numerous ways to segment customers. Traditionally, segments are demographic, geographic, or product based. And, as this marketing plan example illustrates, with basic demographic and geographic information, a retail bank can tailor its marketing efforts so they are personalized to meet consumer demand.

Here are some of the more traditional segmentation categories retail banks may consider:

- Location: Marketing efforts geared toward specific geographic areas.

- Gender: Beneficial when promoting male and female-specific products online.

- Age: Improve age-based predictions about customers. For instance, millennials are more responsive to digital marketing strategies, with most having an email account dedicated to promotional content and over 95% of them subscribing to email lists after “liking” a company’s Facebook page, whereas baby boomers tend to be more financially stable and have higher brand loyalty.

- Income levels: Advertising certain products to customers based on income level. Banks can craft segments based on a wealth model, in which segments are categorized based on similar traits and demographics and give insight into the potential spending for these consumers.

Wealth models are helpful because they convert certain qualitative attributes into quantitative scores. Wealth modeling enables banks to know where to focus their acquisition and marketing efforts to target customers who yield the highest return on investment.

Once this information is gathered, banks refine these segments by analyzing the spending habits and capacity of their customers to increase revenue by knowing which product or service should be offered and when. In recent years, more emphasis has been placed on segments that incorporate customer spending behavior or interests, often getting quite granular with the variables, as there are many factors that impact a customer’s willingness to spend.

Sample Retail Banking Segments

Once a bank is able to categorize and understand the customer they are working with, they can use software to learn how to best assist them. These are three examples of retail banking segments and how they might be approached for relevant services and marketing:

- A family living in the suburbs with two children under age six in a house less than 1200 sq ft, who have a net worth over $500k. This segment could be attractive to candidates looking for home loans to move into a bigger house.

- An existing customer who has only a car loan for $30,000 with your bank, but is also a business owner. This segment can be approached for business banking, line of credit, or equipment loan/leasing.

- An existing customer who has less than $50k in your accounts but who has also been flagged as an accredited investor. This segment could be open to your private banking or wealth management services.

- An existing customer who has a net worth of over $500k and a child, aged 17, who has a debit card with your bank. This segment can be tapped for showing how to help their child build credit using a secured credit card. This works the same way as a debit card, (that their parents might be willing to fund), but their usage and payoff history is reported to the credit agencies to help start building a credit history.

For banks looking to get the most out of their segmentation, knowing how to use wealth and lifestyle information to target the right audience with the correct services is key to retaining customers, and predicting their needs.

How Data Analytics is Used in Retail Banking Customer Segmentation

Once retail banks begin collecting and screening key data from their user base, analytics can be used to turn customer data into actionable insights for each of their consumer segments. As previously stated, data analytics are most commonly used in retail banking customer segmentation to identify common traits or characteristics among customers to personalize service or product offers.

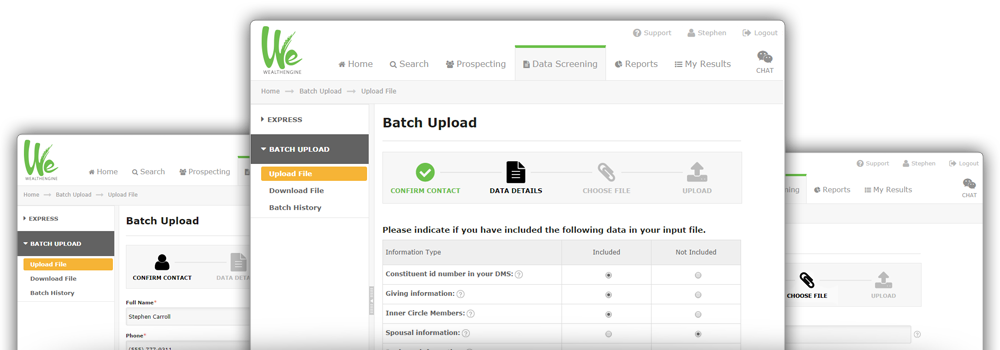

Marketing software helps companies fill in the gaps in their customer database by using data enrichment, data cleansing, secure delivery and real-time updates to maintain high-quality data. Automation offers increased efficiency in comparison to resources lost when spent manually maintaining and updating databases, allowing more time to be allocated toward building stronger relationships with each customer segment.

Banking Customer Buyer Persona

An accurate banking customer buyer persona can drive a lot more client engagement and sales faster. It is driven by data. That’s where doing a wealth screening can really accelerate your marketing efforts.

Wealth screening through WealthEngine uses proprietary wealth scores and ratings and merges them with current customer data, enabling companies to know more about consumers’ interests, political affiliations, net worth, and capacity to spend. These insights can be applied to segments to create a variety of initiatives such as reducing churn rates, improving satisfaction, and more.

With WE Screen, banks can gather analytics on customers from their lifestyle segment using affinity scores applied to their data.

Using a Look-alike Model

Using segmentation and affinity scores, banks can rank consumers by variables such as net worth or cash on hand to identify their most (and least) valuable customer segments, allowing them to concentrate special marketing efforts directly to their top consumers.

Creating a look-alike model for these customers takes this application of data analytics further, allowing banks to target prospect segments they know will yield a higher profit. Look-alike modeling allows banks to gather and identify common traits from a certain customer segment and find new prospects who match those same criteria.

Banks can use this information to create personalized messaging for potential customers who resonate with them from the very first interaction based on the segment(s) they fall into. This often increases conversions and builds stronger relationships with consumers.

Retail banks can use other basic consumer information to more quickly identify trends among customer segments and use it to further personalize interactions. Some of these data points include:

- Acquisition source: Noting where a new consumer was acquired. This helps track where new customers are coming from, enabling banks to capitalize on those channels.

- Initial spending: Banks can identify the first purchase a new consumer makes, helping them to make better predictions about customers’ future needs and purchases.

- Device usage: This enables banks to understand which devices customers use for various services, clarifying what actions can optimize those interactions and engagements.

Because there are so many pieces of customer data that can be analyzed, data mining is becoming increasingly popular for larger financial institutions. Banks use data mining to apply extensive analytics to current data and to spot trends that may not otherwise stand out.

For instance, a bank can use data mining analytics to discover the top 5 attributes shared by customers with the highest lifetime value (LTV). Knowing those key characteristics, banks can concentrate their marketing efforts by creating personalized campaigns targeting high-value customers.

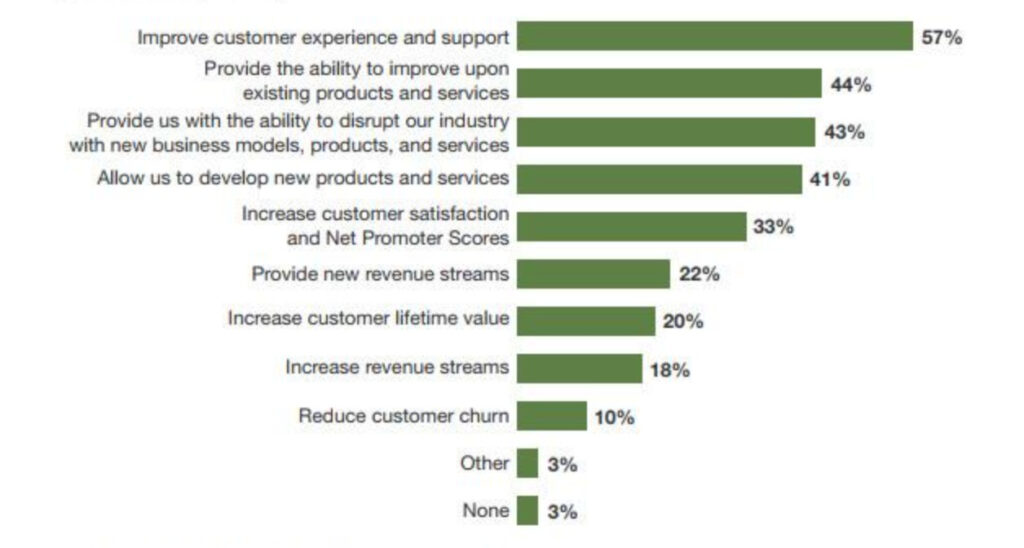

Data analytics performed on customer segments can also be used to create more efficient predictive models for retail banks. When machine learning is integrated, it can use these models to create a smoother customer experience by better forecasting what customers need and when.

Machine Learning

Machine learning is gaining traction and is predicted to have a positive impact on nearly all aspects of larger technology-driven organizations, with 57% of technology professionals expecting machine learning to contribute toward improved customer experience.

Benefits of Retail Banking Customer Segmentation

Through a solid understanding of their customer segments, retail banks can personalize consumer experiences and quickly form genuine relationships with new and existing customers. Improving these efforts leads to reduced costs and increased revenue. A list of common benefits derived from customer segmentation follows:

- Lower Acquisition Costs

Through customer segmentation, banks can deploy more personalized initiatives that increase the likelihood of prospects becoming customers. Banks can also generate specialized efforts toward segments that yield the highest profitability. One way this can be achieved is by using a look-alike model.

- Increased Sales

By knowing customer interests, habits, and desires, banks can offer customers exactly what they are looking for when they need it the most, leading to increased revenue.

- Customer Lifetime Value (CLV) prediction

CLV helps banks identify their most valuable customer segments so they can focus on acquiring customers who generate the most revenue over time.

- Decreased Churn

Creating a personalized experience for retail customer segments increases customer satisfaction, often leading to increased customer retention and brand loyalty, decreasing churn rate.

- Improved Marketing Campaigns

Using customer segments, retail banks can determine the best way to attract new customers, build brand loyalty, and promote specific products. Having a better understanding of the target segments will lead to increased conversion rates.

Customer segmentation makes marketing, product development, and even customer service more effective by helping retail banks gain further insight into specific groupings within their customer base.

To begin segmenting your customer list, visit WealthEngine today to see all of the powerful tools our platform offers to help organizations turn data into action.